Dear friends,

It’s finally fall, my favorite season of the year. The heat abates, the garden quiets, the apples ripen. Chip and I will soon venture north to Wisconsin for leaf peeking and visits to orchards. You’d be amazed at the variety of flavors found in apples; there are about 200 varieties grown in the US, with the average grocery store stocking just a half dozen (including that flavorless favorite, Red Delicious). You’ve still got time to do better. In the Midwest, anyway, October is the month for Haralson and King David, Golden Russet and Creston, Enterprise and Voyager. Heck, you might find a few Lura Red or Wolf Rivers left, if you’re lucky.

And Augustana is beginning to look like Augustana in Autumn.

It feels like a time to breathe again.

Once more into the breach!

When last we wrote, the Gulf Coast had been swept by a huge hurricane and we talked about strategies for reaching out. It feels slightly freakish to note two more major hurricanes hitting the US in the weeks that followed, Irma and Maria. While many areas of the mainland US were devastated, reports coming out of the Caribbean talk about an apocalypse where entire islands had their homes and infrastructure disappear. Even now, only one Puerto Rican in 20 has electricity, fewer than half have access to safe drinking water and … horror of modern horrors … only 14% of the cell phone network is functioning.

For those wishing to reach out, the best resource I’ve found is Charity Navigator, a non-profit that rates charities by the efficiency of their efforts. Charity Navigator has a page devoted to agencies providing support to hurricane victims. We can’t fix it all, but that seems a poor argument for choosing to do nothing. And so, we try.

Driving the porcelain … uhh, portfolio

Many of us have reached the same miserable moment. It’s 2:00 a.m. We’ve got a stomach virus. We’re miserable and we know what’s coming. But, perhaps after a false alarm or two, it hasn’t come … yet.

And so you sit. And you think, “oh, god. Let’s just get this over with and get on with life.”

That’s about where I am now. The stock market is historically overpriced, and becoming more so by the day.

Index averages generally reflect the performance of a few huge, hot stocks (the FANGs). To eliminate that bias, investors sometimes look at the performance and pricing of the median stock in an index; that is, the S&P 500 stock ranked 250th in costliness. By such measures, GMO notes: “the average US stock has never been more expensive than it is currently, even at the height of the insanity that was the TMT bubble of the late 1990s. We have never seen such broad-based overvaluation of US equities.”

With a special tip of the hat to Eric Cinnamond and the folks at the Towle Deep Value Fund (TDVFX, closed to new investors), GMO ran a valuation screen suggested by Benjamin Graham, designed to identify “deep value” stocks. The screen looks at earnings yield relative to bonds, dividend yield relative to bonds, total corporate debt and 10-year price/earnings ratio. Using that test, “in the US not a single stock passes the screen. Not one single solitary stock can be called deep value.”

Jason Zweig, more perma-brain than perma-bear, is writing a series of stories this month to commemorate the October 16, 1987 crash in which the Dow lost nearly a quarter of its value in eight hours. It had been a banner year in the market, it was up 30% by October, despite rising interest rates, international bickering, skirmishes with Iran and concern over tax policy. It was a banner year … right up to the moment it wasn’t.

History does offer a few clear lessons.

Stocks have been overvalued, by long-term standards, for most of the past three decades. So, on average, you were more likely to have missed consistent gains than to have dodged a crash if you got out of the market entirely.

Investors today who hold large positions in the hottest stocks … should consider trimming their positions, however. In 1987, as in 1929, the stocks that had previously gone up the most tended to fall the farthest.

Above all, says Staley Cates, vice chairman of Southeastern Asset Management in Memphis, Tenn., “don’t be afraid to hold cash.” On Oct. 19, 1987, he and his young colleagues clustered around a Quotron machine putting in buy orders as they watched the market crash, “and the ultimate comfort we had that day was holding 25% to 30% of our portfolios in cash.”

Without it, “we couldn’t have bought stocks,” he says. Having the cash to buy when others are selling is the surest source of courage in a crash.

Mr. Graham’s advice for such moments was about the same: “When such opportunities have virtually disappeared, past experience indicates that investors should have taken themselves out of the stock market and plunged up to their necks in US Treasury bills.” Matt Kadnar and James Montier of GMO might secretly agree, but their public position is “anywhere but here.”

The cruel reality of today’s investment opportunity set is that we believe there are no good choices from an absolute viewpoint … you are reduced to trying to pick the least potent poison… For a relative investor (following the edicts of value investing), we believe the choice is clear: Own as much international and emerging market equity as you can, and as little US equity as you can. If you must own US equities, we believe Quality is very attractive relative to the market.

None of which means that a crash impends. Both the Leuthold Group and Birinyi Associates report that we’re not seeing the usual pattern of behavior that signals a “final top” to the market. The market strategists at Bank of America Merrill Lynch argue for a final “melt up” preceding a crash, which they’ve dubbed “the Icarus trade.”

Bearish commentators concede that the market has been overpriced by historical measures for nearly 30 years, so maybe it’s time to toss history out as being old-fashioned and out-of-date. On the other hand, on the last 20 years we’ve also experienced two of the three worst crashes in modern history bracketed by “the lost decade” in which the S&P 500, including dividends, ended the decade 9.1% lower than where it began.

Which leaves us where, exactly? In general, our advice is the same:

- Don’t put more money at risk than you can afford to lose. If your portfolio’s allocation is already attuned to your willingness to lose money, you’re golden! As we’ve noted before, my non-retirement portfolio is about 50% equities and 50% income. The equities are split between “here” and “there,” the income is split between foreign and domestic bonds and cash-like securities. When Icarus tumbles, I’d likely lose 18% or 20%. I can live with that. You might want to have the same sense.

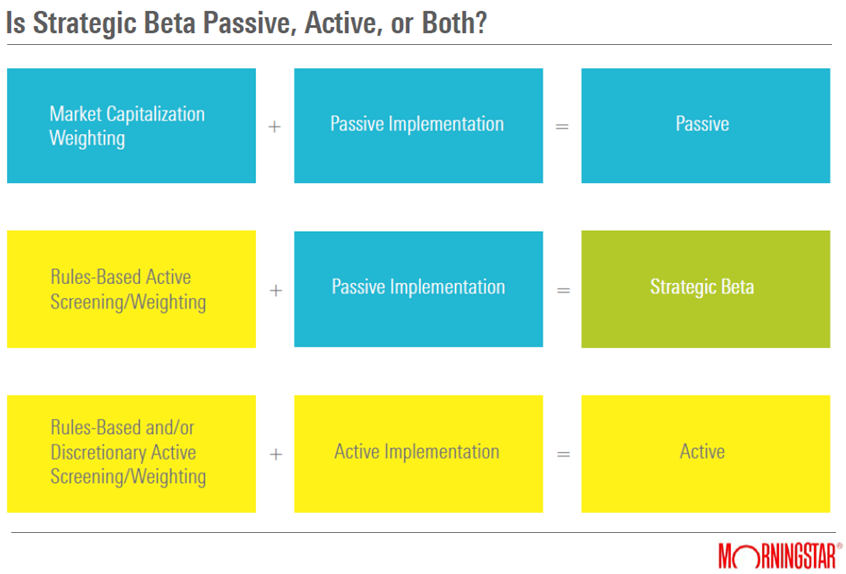

- Prefer active over passive. At the very least, market cap-weighted funds have a momentum bias on the upside (as Amazon soars, so does its p/e ratio – 240x – and its weight in the S&P 500) and no way of protecting on the downside.

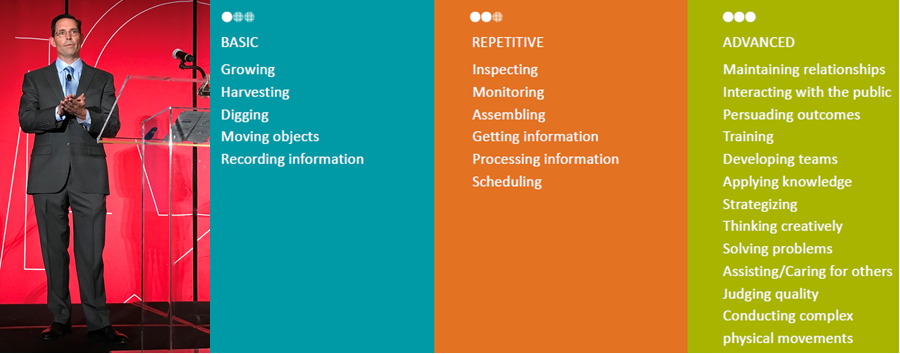

- Prefer independence over the herd. There are managers out there who aren’t blindly following the path of least resistance. David Marcus at Evermore Global Value (EVGBX), John Deysher at Pinnacle Value (PVFIX), Jaymie Wiggins at Intrepid Endurance (ICMAX), Steve Romick at FPA Crescent (FPACX), Zeke Ashton at Centaur Total Return (TILDX) and many of the folks in the Dry Powder Gang are doing the hard and painful work now to be sure their investors are intact come what may.

- Prefer experience over inexperience. Mike Tyson famously observed, “everyone has a plan until they get punched in the mouth.” It would be awfully reassuring to trust your fortune to someone who’s already survived a few bouts. While investors like Ryan Caldwell at Chiron Capital Allocation (CCAPX), Amit Wadhwaney at Moerus Worldwide Value (MOWVX) or Abhay Desphande at Centerstone Investors (CENTX) have a lot of experience, though the fact that their current funds are young masks that fact.

And then, we wait.

All of which leaves me feeling like a guy with a stomach virus.

Shukran, gràcies, dank u, mahalo, grazie, arigatô, tack … and thanks!

Thanks to Deb, Greg, and Brian. And, also, to Gregory (not to be confused with Greg). Your continued support keeps us going each month.

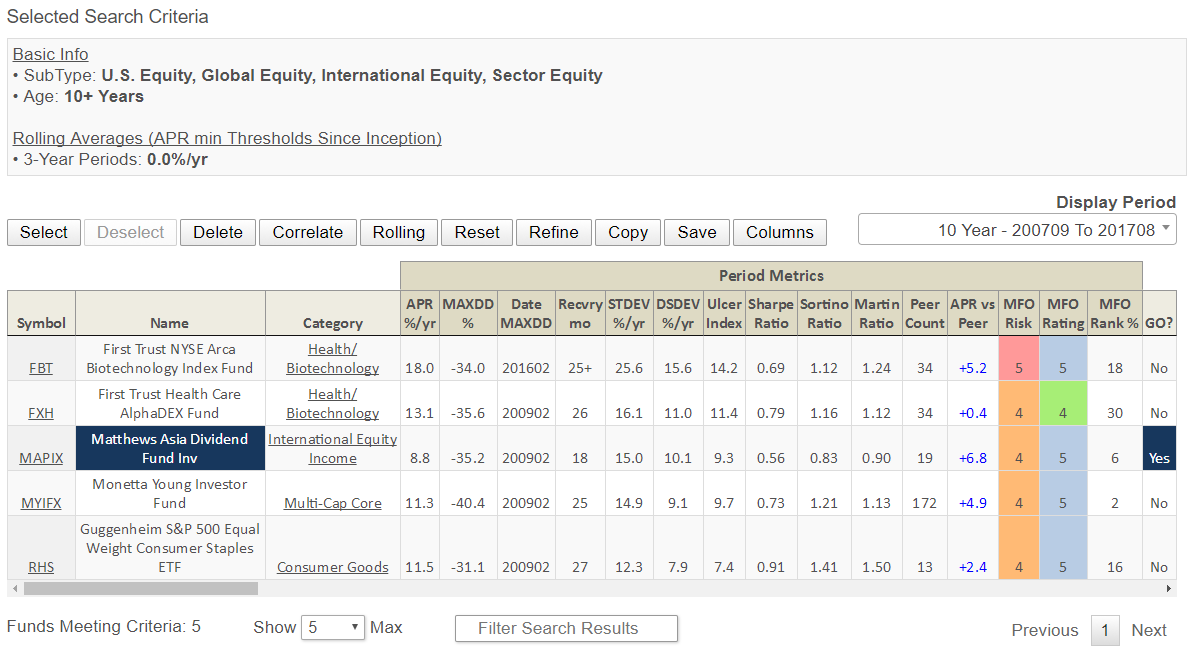

Thanks, most especially, to an anonymous donor for her kind gift. Charles happily reports that it “buys us time to implement continued enhancements that folks have asked for, like rolling averages and portfolio analysis, as well as purchasing expert support with our DataTables interface and our Encodable front-end user management/login/re-subscription software.” I’m a little fuzzy on what that means; Chip assures me that it translates to a more powerful, more responsive suite of tools for folks using MFO Premium.

A more secure MFO

Late in September, Chip added a new security certification for MFO. Now when you come to MFO, your browser bar should have a little green lock icon and an “https” designation that indicates it’s a secure site.

![]()

Since we don’t collect personal information, or even track our readers, that’s mostly a matter of symbolic affirmation and keeping up with the best practices recommended by internet security professionals. Just thought you’d like to know.

From 2000 – mid-2014,Mr. Caldwell managed several funds for Waddell &Reed, including Ivy Asset Strategy, W&R Asset Strategy, and Ivy Funds/VIP. Morningstar made him a manager of the Year finalist in 2007 and Institutional Investor tagged him as one of the “Rising Stars of Mutual Funds” in 2009. He’s made the best of the opportunity since Chiron attracting $1.3 billion in assets in its first couple years. CCAPX’s one year return through September 2017 placed it as 2nd of 137 “growth allocation” funds (Lipper), behind only CGM Mutual Fund (LOMMX), or 1st of 105 “world allocation” funds (Morningstar).

From 2000 – mid-2014,Mr. Caldwell managed several funds for Waddell &Reed, including Ivy Asset Strategy, W&R Asset Strategy, and Ivy Funds/VIP. Morningstar made him a manager of the Year finalist in 2007 and Institutional Investor tagged him as one of the “Rising Stars of Mutual Funds” in 2009. He’s made the best of the opportunity since Chiron attracting $1.3 billion in assets in its first couple years. CCAPX’s one year return through September 2017 placed it as 2nd of 137 “growth allocation” funds (Lipper), behind only CGM Mutual Fund (LOMMX), or 1st of 105 “world allocation” funds (Morningstar). Here’s

Here’s